Comprehending Just How Credit History Repair Service Functions to Enhance Your Financial Health And Wellness

The process includes recognizing errors in credit score reports, disputing mistakes with credit score bureaus, and bargaining with financial institutions to deal with superior debts. The inquiry remains: what certain methods can people employ to not only fix their credit score standing however additionally make sure lasting monetary stability?

What Is Credit Score Repair Service?

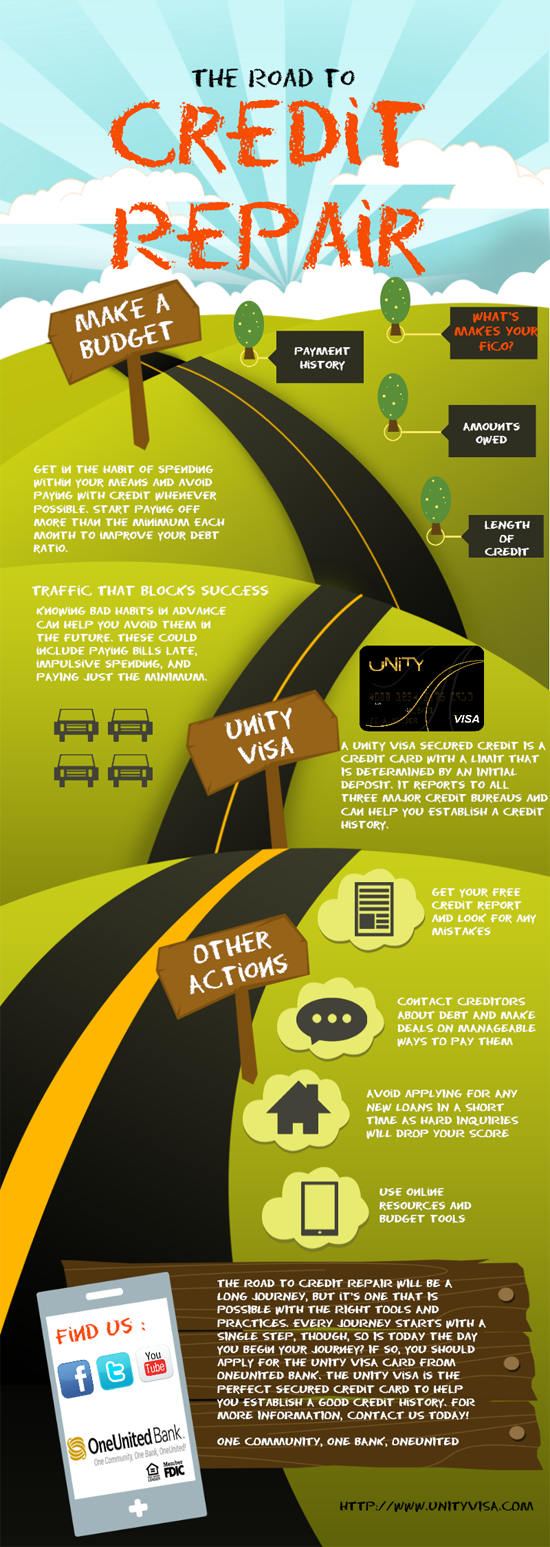

Credit report fixing describes the procedure of improving a person's creditworthiness by attending to mistakes on their credit rating report, negotiating financial obligations, and taking on better economic behaviors. This complex approach aims to boost an individual's credit report, which is a critical consider securing fundings, bank card, and favorable rate of interest.

The credit score repair service process normally begins with a complete testimonial of the individual's credit score record, permitting for the recognition of any kind of disparities or errors. The specific or a debt repair expert can launch conflicts with credit bureaus to rectify these concerns when inaccuracies are determined. In addition, bargaining with creditors to work out arrearages can better enhance one's monetary standing.

In addition, taking on prudent monetary practices, such as prompt bill repayments, lowering credit report usage, and maintaining a varied debt mix, contributes to a healthier credit report account. On the whole, credit rating fixing works as an essential technique for individuals looking for to regain control over their monetary health and wellness and protect much better borrowing possibilities in the future - Credit Repair. By engaging in credit history fixing, people can lead the way toward attaining their monetary goals and improving their total top quality of life

Common Credit Score Report Mistakes

Mistakes on credit score records can substantially affect an individual's credit rating, making it essential to understand the typical kinds of inaccuracies that might arise. One common issue is incorrect personal information, such as misspelled names, incorrect addresses, or incorrect Social Security numbers. These errors can cause complication and misreporting of credit reliability.

Another common mistake is the reporting of accounts that do not come from the individual, typically due to identity burglary or clerical errors. This misallocation can unjustly lower a person's credit rating. In addition, late payments might be inaccurately taped, which can occur as a result of repayment processing errors or wrong reporting by loan providers.

Credit report limitations and account equilibriums can additionally be misstated, leading to a distorted sight of an individual's credit history usage ratio. Recognition of these usual mistakes is critical for effective credit score management and repair, as addressing them without delay can aid individuals maintain a healthier economic account - Credit Repair.

Steps to Disagreement Inaccuracies

Challenging errors on a credit history report is a crucial procedure that can assist bring back a person's creditworthiness. The very first step includes acquiring a current copy of your credit history report from all 3 major credit score bureaus: Experian, TransUnion, and Equifax. Testimonial the record thoroughly to recognize any kind of mistakes, such as incorrect account details, balances, or settlement backgrounds.

As soon as you have determined discrepancies, collect supporting paperwork that validates your claims. This may include financial institution declarations, settlement verifications, or document with lenders. Next, initiate the conflict process by contacting the pertinent Visit Your URL credit bureau. You can commonly file disagreements online, through mail, or by phone. When sending your disagreement, clearly lay out the mistakes, give your evidence, and consist of individual identification information.

After the disagreement is filed, the credit bureau will examine the claim, usually within 30 days. They will connect to the lender for verification. Upon conclusion of their examination, the bureau will educate you of the result. If the dispute is solved in your support, they will remedy the record and send you an upgraded duplicate. Maintaining accurate records throughout this procedure is crucial for reliable resolution and tracking your credit history wellness.

Building a Strong Credit Rating Profile

Developing a solid credit scores account is vital for securing favorable monetary chances. Regularly paying credit scores card costs, lendings, and various other obligations on time is vital, as payment history significantly impacts credit ratings.

Moreover, keeping reduced credit rating use proportions-- ideally under 30%-- is vital. This means maintaining credit report card equilibriums well below their restrictions. Branching out credit rating types, such as a mix of rotating credit (credit report cards) and installment car loans (automobile or home mortgage), can additionally improve credit score profiles.

On a regular basis keeping track of debt reports for errors is similarly essential. People ought to review their debt records at the very least every year to determine discrepancies and contest any type of mistakes immediately. Furthermore, avoiding too much credit rating inquiries can avoid possible negative effect on credit report.

Lasting Benefits of Credit Repair

Furthermore, a stronger credit scores account can promote better terms go for insurance coverage costs and also influence rental applications, making it simpler to protect real estate. The emotional advantages should not be neglected; individuals that successfully fix their credit report typically experience reduced stress and anxiety and enhanced confidence in handling their financial resources.

Conclusion

In final thought, credit rating repair service offers as a vital device for enhancing monetary health and wellness. By recognizing and disputing errors in credit rating reports, people can correct errors that adversely affect their credit rating ratings.

The long-lasting benefits of credit scores repair service extend far past just boosted credit rating ratings; they can significantly boost a person's overall monetary health.